Get This Report on Pacific Prime

Get This Report on Pacific Prime

Blog Article

The smart Trick of Pacific Prime That Nobody is Discussing

Table of ContentsAn Unbiased View of Pacific Prime9 Simple Techniques For Pacific PrimeRumored Buzz on Pacific PrimeHow Pacific Prime can Save You Time, Stress, and Money.The Definitive Guide for Pacific Prime

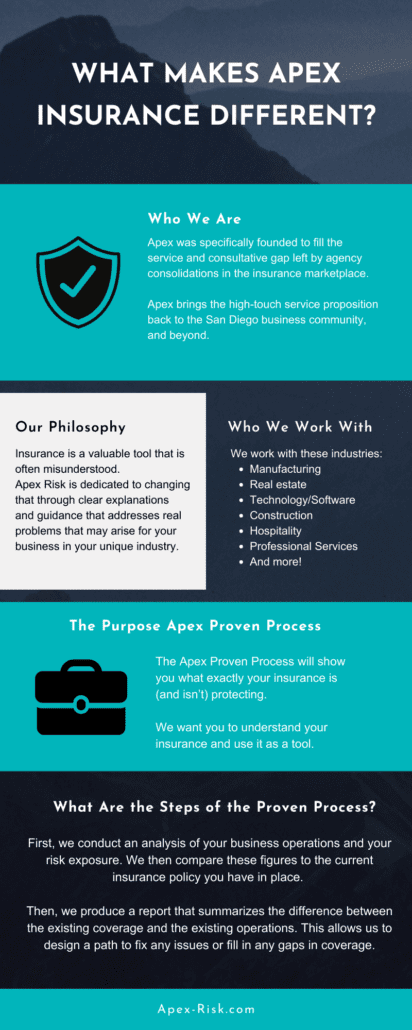

Insurance policy is an agreement, stood for by a policy, in which a policyholder receives monetary protection or repayment against losses from an insurance provider. The firm pools customers' threats to pay more budget-friendly for the guaranteed. Most individuals have some insurance policy: for their automobile, their house, their health care, or their life.Insurance likewise helps cover prices connected with obligation (legal duty) for damages or injury triggered to a 3rd party. Insurance is a contract (plan) in which an insurer compensates another versus losses from details contingencies or hazards. There are several sorts of insurance plan. Life, health and wellness, homeowners, and vehicle are amongst one of the most typical kinds of insurance policy.

Investopedia/ Daniel Fishel Lots of insurance plan types are readily available, and virtually any type of specific or business can locate an insurance coverage firm prepared to guarantee themfor a rate. Many people in the United States have at least one of these types of insurance policy, and cars and truck insurance is required by state legislation.

9 Simple Techniques For Pacific Prime

Locating the price that is appropriate for you requires some legwork. The policy limit is the maximum amount an insurer will spend for a protected loss under a policy. Optimums might be set per period (e.g., annual or policy term), per loss or injury, or over the life of the plan, also called the life time optimum.

Policies with high deductibles are generally more economical because the high out-of-pocket expenditure normally causes fewer small insurance claims. There are various kinds of insurance policy. Allow's check out one of the most crucial. Wellness insurance coverage helps covers routine and emergency situation treatment expenses, usually with the choice to add vision and oral services separately.

Nevertheless, several preventative solutions may be covered for cost-free prior to these are fulfilled. Medical insurance may be bought from an insurer, an insurance agent, the federal Medical insurance Industry, given by a company, or government Medicare and Medicaid insurance coverage. The federal government no more requires Americans to have health and wellness insurance, however in some states, such as California, you may pay a tax charge if you don't have insurance.

The Ultimate Guide To Pacific Prime

Rather than paying out of pocket for vehicle crashes and damage, people pay annual costs to an automobile insurance provider. The business after that pays all or many of the protected prices linked with an auto mishap or other automobile damages. If you have a rented lorry or borrowed money to buy a vehicle, your loan provider or renting dealership will likely need you to lug auto insurance coverage.

A life insurance policy plan assurances that the insurance firm pays a sum of cash to your recipients (such as a spouse or kids) if you die. In exchange, you pay premiums during your lifetime. There are 2 major kinds of life insurance policy. Term life insurance coverage covers you for a specific duration, such as 10 to twenty years.

Insurance coverage is a way to manage your economic risks. When you purchase insurance coverage, Recommended Site you buy defense against unanticipated economic losses. The insurance policy firm pays you or someone you pick if something bad occurs. If you have no insurance coverage and a mishap takes place, you might be liable for all associated costs.

Pacific Prime Things To Know Before You Buy

Although there are numerous insurance plan kinds, several of one of the most typical are life, health, homeowners, and car. The ideal sort of insurance coverage for you will certainly depend upon your objectives and monetary circumstance.

Have you ever before had a minute while looking at your insurance coverage policy or buying for insurance policy when you've believed, "What is insurance policy? Insurance policy can be a strange and puzzling thing. Just how does insurance work?

Experiencing a loss without insurance can put you in a challenging monetary situation. Insurance is a crucial financial device.

5 Easy Facts About Pacific Prime Shown

And sometimes, like vehicle insurance policy and workers' settlement, you may be needed by regulation to have insurance coverage in order to safeguard others - expat insurance. Discover ourInsurance choices Insurance policy is basically a massive nest egg shared by many individuals (called insurance holders) and taken care of by an insurance coverage copyright. The insurer uses money accumulated (called premium) from its insurance policy holders and various other investments to spend for its operations and to accomplish its guarantee to insurance holders when they file a case

Report this page